salt tax impact new york

New York States new budget for 2022 included an elective Pass-Through Entity Tax PTE and a corresponding personal income tax credit regime which will allow NYS taxpayers to avoid some of the impact of the SALT limit. Enacted by the Tax Cuts and Jobs Act in 2017 the SALT cap has been a pain point for filers in high-tax states such as New York and New Jersey.

Pin By Ashutosh Dodamani On Amazing Nature Amazing Nature Golden Gate Bridge Golden Gate

After the limit became effective the SALT cost in lost federal revenue was lowered to an estimated 565 billion for FY 2019 and 589 billion for FY 2020 thus resulting in a revenue savings of.

. What a convenient reminder for New Jersey voters right before the midterms. Overall the SALT deductions value as a portion of AGI fell between 2016 and 2018. New York supports 107000 fewer additional.

In California the deductions value fell from 81 percent in 2016 to just 18 percent in 2018. SALT deductions were limited to 10000 as part of former President Donald Trumps tax reform plan in 2017 hurting residents of. Cuomos initial budget proposal in January and it comes at a time when many Democrats are calling on Pres.

For your 2021 taxes which youll file in 2022 you can only itemize when your individual deductions are worth more than the 2021 standard deduction of 12550 for single filers 25100 for joint filers and 18800 for heads of household. The provision was part of Gov. Rather than repealing SALT especially now when the need to spend on public health and education is clearer than ever the limit on.

In the 500000 to 1 million bracket the drop was from 68 percent to 33 percent. Over the weekend New York became the first state to create a state and local tax SALT deduction cap workaroundtwo workarounds in fact since New York does nothing on a small scale. This consequential tax legislation available to electing pass-through entities provides a mechanism for New York State individual taxpayers to limit the impact of the.

This report shows that the cap which is effectively a tax increase for New Yorkers is having a sustained negative effect on employment and output in New York State. Yet while the newly adopted budget encourages high-income taxpayers to take advantage of these provisions they ought to come with a warning. On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after January 1 2021.

The SALT cap increase will have the biggest effect on high-income-tax states like New York California and New Jersey said certified financial planner Matthew Benson owner at Sonmore Financial. The Rockefeller Institute of Government and the New York State Division of the Budget have examined the impact of the SALT cap. Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction a study by the Urban-Brookings Tax.

WASHINGTON A plan by House Democrats to reduce taxes for high earners in states like New Jersey New York and California in their 185 trillion social policy spending package. In 2018 Maryland was the top state at 25 percent of AGI. 52 rows The SALT deduction is only available if you itemize your deductions using Schedule A.

The state with the largest amount of SALT deductions as a portion of AGI in 2016 was New York at 94 percent. After legislators realized the impact of this it was decided to simply reduce the SALT deduction to 10000. In the 200000 to 500000 income bracket the incidence of AMT filers fell from 816 percent to 17 percent.

Almost 11 million taxpayers are likely to feel the pinch of a new cap on deducting state and local taxes also known as SALT deductions. The 10000 SALT cap was imposed starting in 2018 as a way to pay for some of the levy cuts in former President Donald Trumps tax cut law. SALT remains a top priority.

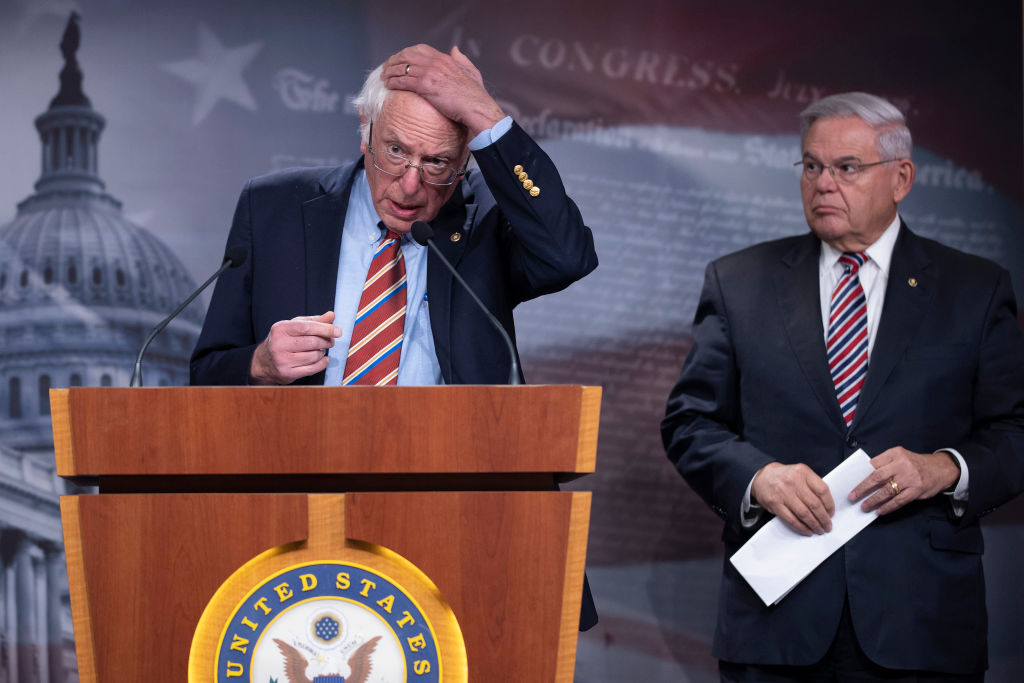

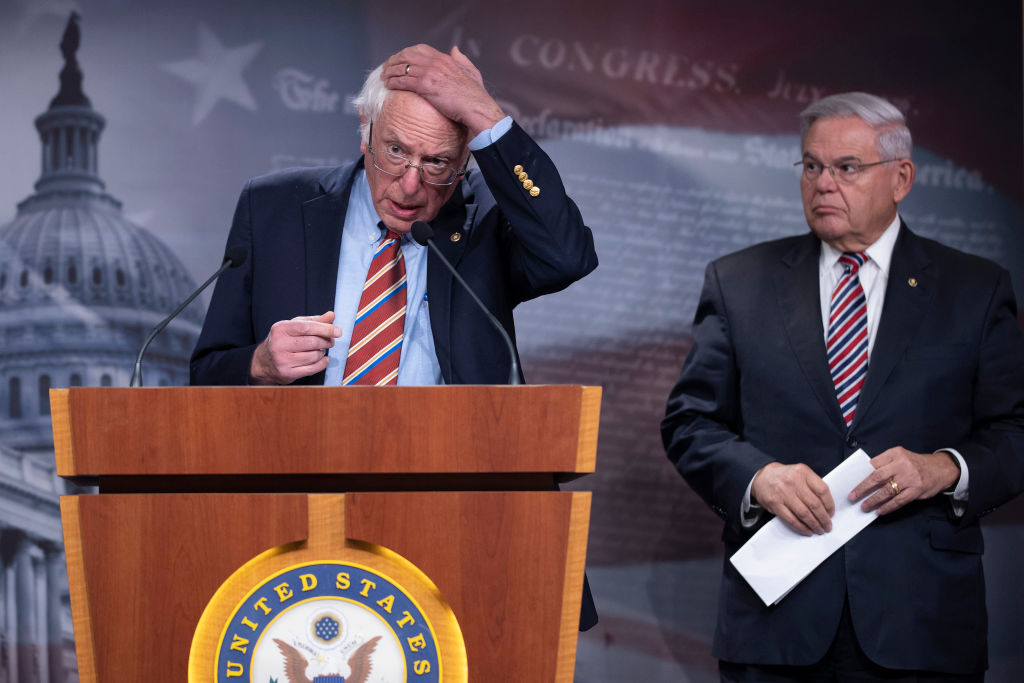

Bernie Sanders criticizes Inflation Reduction Act says it will have minimal impact House representatives from high-tax states such as New Jersey New York and California have made the issue a sticking point for any budget bill that comes to the table arguing the cap harms their higher-earning constituents. Before President Donald Trump signed the Tax Cuts and Jobs. The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction.

April 7 2021 Louis Vlahos Tax. Democrats say the measure was intended to target. And some lawmakers have been fighting to include a.

Starting with the 2018 tax year the maximum SALT deduction available was 10000. They touch on two recent decisions that came out in New York one from the Tax Appeals Tribunal and one from the Appellate Division as Chelsea is quick to correct Jeremy. OK so the Republicans have New Jersey House Democrats dead to rights on their No SALT No Deal pledge.

On this episode of the SALT Shaker Podcast Eversheds Sutherland Associates Jeremy Gove and Chelsea Marmor discuss all things New York personal income tax. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. According to IRS data the share of New York taxpayers hit by the AMT fell sharply in 2018from 59 percent of filers in 2017 to just 02 percent in 2018.

The New York state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions the SALT cap.

All About Salt The Tax Deduction That Divides The U S The Washington Post

Austin Texas Skyline Peel And Stick Wall Mural Peel And Stick Wallpaper Home Decor Wall Art Limitless Walls

New York Enacts Pass Through Entity Tax Election As Salt Deduction Workaround Our Insights Plante Moran

Nyc Home Prices Plunge After Salt Deductions Capped

Art Print New England Travel Ads Poster By Lantern Press 24x18in England Map Map Art Print New England

Why This Tax Provision Puts Democrats In A Tough Place Time

Us Commercial Real Estate Prices Plunged In April Mall Prices Collapsed Naked Capitalism

/cdn.vox-cdn.com/uploads/chorus_image/image/70105881/1236366936.0.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

Pin By Ashutosh Dodamani On Amazing Nature Amazing Nature Golden Gate Bridge Golden Gate

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

San Francisco S Painted Ladies In The Alamo Square Neighborhood Is One Of The Most Photographed Loc San Francisco Restaurants San Francisco Visit San Francisco

The Salt Deduction There S A Baffling Tax Gift To The Wealthy In The Democrats Social Spending Bill The Washington Post

Photo By Jason Chen Unsplash Taiwan Travel Singapore Travel Taipei

Mit Reopens Oculus Atop Great Dome

Ast Week The United States Fish And Wildlife Service Which Is Part Of The U S Department Of The Lake Michigan Chicago Indiana Dunes State Park Indiana Dunes